Latest Version

0.3

August 15, 2024

e& UAE

Finance

Android

76

3

com.etisalat.ewallet&hl=en

Report a Problem

More About e& money

The Evolution of E& Money

E& Money, previously known as Etisalat Money, was launched as part of Etisalat's strategy to diversify its offerings beyond traditional telecommunications. As the world shifted towards digital payments, Etisalat recognized the need for a secure, reliable, and user-friendly digital wallet. E& Money was designed to meet these needs, providing a seamless platform for managing finances directly from mobile devices.

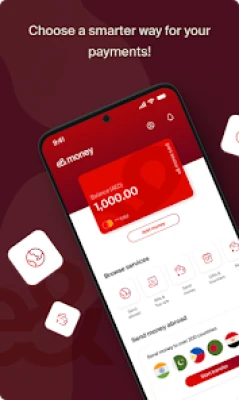

Key Features of E& Money

User-Friendly Interface

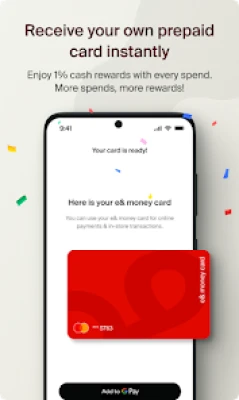

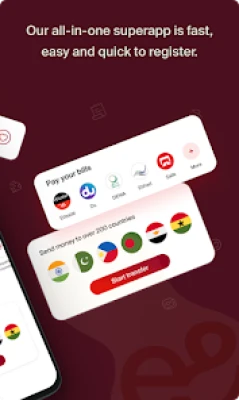

E& Money is designed with simplicity in mind, ensuring that users of all ages and tech-savviness levels can navigate the app effortlessly. The intuitive layout allows users to quickly access various features such as transfers, bill payments, and mobile recharges.Wide Range of Services

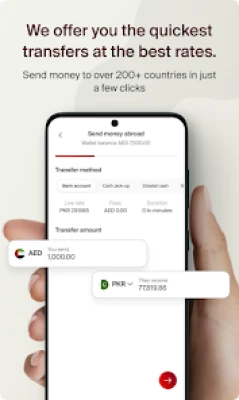

E& Money offers an extensive array of services, including:- Money Transfers: Users can transfer money domestically within the UAE or internationally to various countries. Whether sending money to family members or paying for services, E& Money makes the process quick and hassle-free.

- Bill Payments: E& Money allows users to pay utility bills, such as electricity, water, and internet, directly through the app. This eliminates the need to visit multiple websites or payment centers.

- Mobile Recharges: Users can easily recharge their Etisalat or other mobile accounts using E& Money. The app also supports recharges for friends and family members.

- Merchant Payments: E& Money can be used to make payments at various partner merchants, making shopping and dining out more convenient.

Security Features

One of the primary concerns with digital wallets is security. E& Money addresses this by implementing robust security measures:- Two-Factor Authentication (2FA): To ensure that only authorized users can access the app, E& Money requires two-factor authentication, adding an extra layer of security.

- Encryption: All transactions made through E& Money are encrypted, protecting sensitive information from potential cyber threats.

- Real-Time Alerts: Users receive real-time notifications for every transaction, enabling them to monitor their account activity closely and detect any unauthorized actions immediately.

Convenience and Accessibility

E& Money is accessible 24/7, allowing users to manage their finances anytime and anywhere. The app supports multiple languages, catering to the diverse population of the UAE. Additionally, it is compatible with both Android and iOS devices, ensuring broad accessibility.Partnerships and Collaborations

E& Money has forged partnerships with various local and international organizations to expand its services. For example, collaborations with banks and remittance services allow users to send money to multiple countries with favorable exchange rates and minimal fees.

Benefits of Using E& Money

Time-Saving

With E& Money, users can complete multiple transactions from the comfort of their homes or on the go. This saves time that would otherwise be spent visiting payment centers or banks.Cost-Effective

E& Money often provides lower fees for transactions compared to traditional banking services. Additionally, users can take advantage of promotional offers and discounts available through the app.Financial Management

E& Money allows users to keep track of their spending and transactions. The app provides detailed transaction history, helping users manage their budgets and financial planning effectively.Inclusive Services

E& Money caters to a broad audience, including those who may not have access to traditional banking services. This inclusivity makes it an essential tool for financial empowerment in the UAE.

Fees Associated with E& Money

While E& Money offers many services free of charge, some transactions may incur fees. Understanding these fees is crucial for users to make informed decisions:

Domestic Transfer Fees

Sending money within the UAE typically involves a small fee. The exact amount can vary depending on the transfer amount and the method used.International Transfer Fees

International remittances through E& Money may come with a fee, depending on the destination country and the transfer method. However, E& Money often provides competitive rates, making it a cost-effective option for sending money abroad.Bill Payment Fees

While many bill payments are free, certain service providers may charge a small processing fee. Users should check the app for details on specific fees related to their bills.ATM Withdrawal Fees

Withdrawing cash from an ATM using E& Money may incur a fee, particularly if the ATM is outside the network. Users are advised to check for applicable fees before making withdrawals.Service Charges

E& Money may apply service charges for specific transactions, such as card payments or account maintenance. These fees are usually nominal but should be considered when using the app.

Security Measures of E& Money

Security is a top priority for E& Money, and the platform has implemented several measures to protect users' financial information:

Data Encryption

All data transmitted through E& Money is encrypted, ensuring that sensitive information is protected from unauthorized access.Two-Factor Authentication (2FA)

Users must verify their identity through a secondary method, such as a text message or email code, before accessing their accounts. This helps prevent unauthorized access.Real-Time Transaction Alerts

E& Money sends instant notifications for every transaction, allowing users to monitor their accounts in real time and report any suspicious activity immediately.Fraud Detection

The platform employs advanced algorithms to detect and prevent fraudulent activities, safeguarding users from potential scams.

Conclusion

E& Money has revolutionized the way people in the UAE manage their finances. Its user-friendly interface, wide range of services, and robust security measures make it a valuable tool for anyone looking to simplify their financial life. While certain fees apply, the convenience and efficiency offered by E& Money outweigh these costs, making it a smart choice for digital financial management. As digital financial services continue to evolve, E& Money stands out as a leading platform, helping users stay ahead in the digital age.

This article provides a comprehensive overview of E& Money and can be used as a detailed guide for readers interested in understanding the platform.

Rate the App

User Reviews

Popular Apps

Editor's Choice